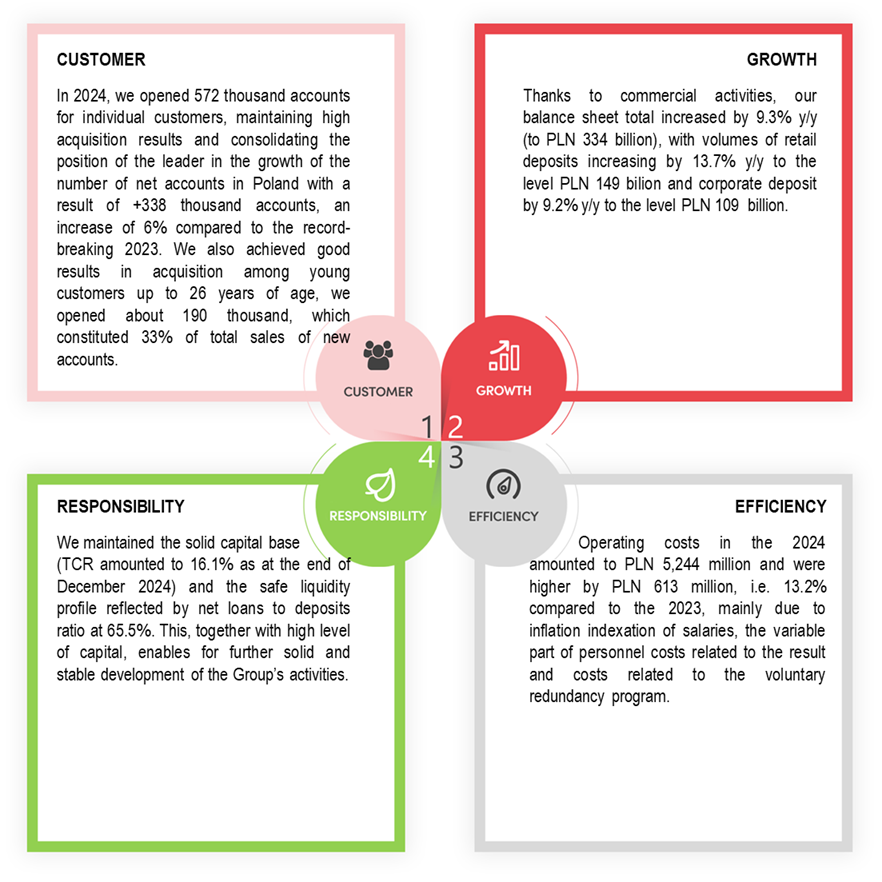

Operating costs in the 2024 amounted to PLN 5,244 million and were higher by PLN 613 million, i.e. 13.2% compared to the 2023, mainly due to inflation indexation of salaries, the variable part of personnel costs related to the result and costs related to the voluntary redundancy program.

The Net allowances for expected credit losses in the amounted to PLN 883 million and was higher by PLN 257 million, i.e. 41.1% than in 2023. The Group’s cost of risk in 2024 amounted to 0.48%, up 0.12 p.p. from the previous year, and are in line with the strategic assumptions and the adopted risk appetite.

Contributions to the Bank Guarantee Fund in 2024 amounted to PLN 239 million and were higher by PLN 49 million i.e. 25.8% than in 2023, due to the increase in the volume of guaranteed funds.

The tax on certain financial institutions in 2024 amounted to PLN 898 million and was higher by PLN 19 million, i.e. 2.2% than in 2023 due to the increase in the Bank’s assets.