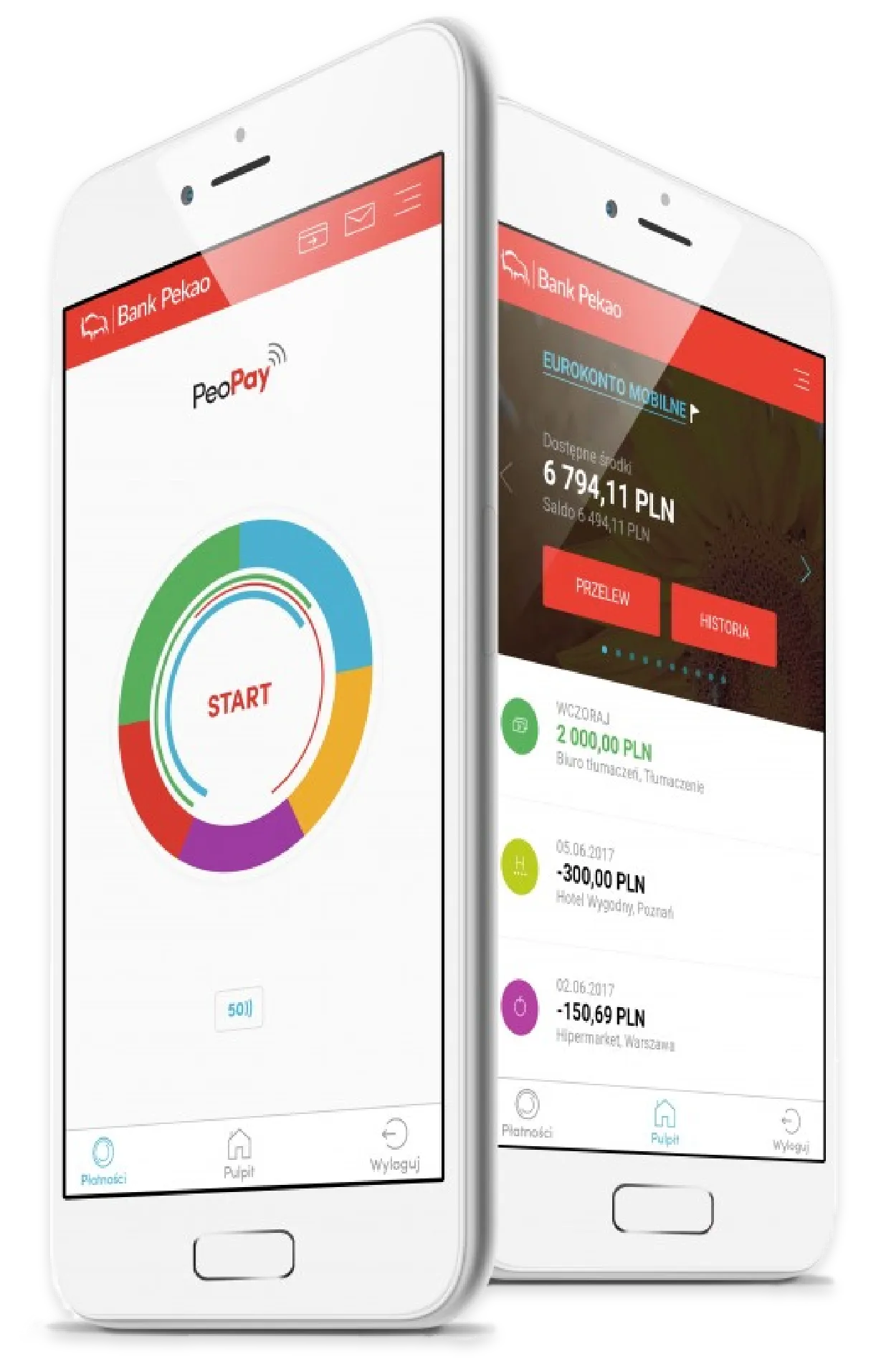

In 2022, the number of active mobile banking customers increased by 359 thousand - up to 2.76 million. PeoPay is one of the best-rated financial applications available in Google Play and AppStore.

Year full of challenges

– year of responsibility

The past year was full of challenges, most of which were caused by Russia’s aggression in Ukraine. Since the end of February last year, the energy crisis has sharply escalated; Poland has become a frontline state, and the Capital Group of Bank Pekao S.A. engaged strongly in the help towards the war refugees from Ukraine. In the economic sphere, the direct effect of the Russian aggression was a strong inflationary pressure caused by a supply shock on the commodity market, a large number of one-off and unusual events affecting the results of Bank Pekao and the entire banking sector, and further unfavorable developments regarding foreign currency mortgage loans took place. In these demanding conditions, the Pekao Group did well, demonstrating its balance sheet strength, lower-than-sector risk exposure and resilient business model.

Mobile Banking

Innovations

Results

Bank in 2022

Strategy’s implementation

Summary

We are on track to fulfill our ESG Strategy

Strategy of Bank Pekao S.A. for 2021-2024 was developed in an environment of historically low interest rates. A series of interest rate increases that have taken place since then (increase in the reference rate from 0.1% at the beginning of 2021 to 6.75% in 2022) has had a significant impact on the growth trajectory of the Bank's net interest income in 2022. in relation to strategic assumptions. The Bank's financial results in 2022 were also affected by a number of one-off events.

| Strategic goals of Bank Pekao | 2021 | 2022 | Target |

|---|---|---|---|

| Implementation | |||

| ROE (%) | 8.70% | 7.60% | ~10% |

| C/I (%including to contributions to the BFG1 cost and fee paid for the Protection Schemes2) | 47.30% | 44.90% | 42% |

| Active mobile banking customers (m) | 2.4 | 2.8 | 3.2 |

| Digitisation rate (%) | 57% | 69% | ~100% |

2 Protection Scheme referred to in Art. 4 sec. 1 point 9a of the Act of August 29. 1997 - Banking Law.

We implement our ESG Strategy as planned

The Bank aims to integrate ESG into all key processes of Pekao’s operations, including lending, investment and advisory, purchasing, and the incentive system. The Bank also recognizes the potential inherent in ESG product offerings and is taking steps to increase its “green” portfolio across all business segments. Transparency of ESG policies and non-financial reporting remains a priority, especially in the context of recent regulations.

| Strategic goals of Bank Pekao | 2021 | 2022 | Target |

|---|---|---|---|

| Implementation | |||

| Financing of sustainable projects (PLN bn) | 0.9 | 4.3 | >8 |

| Support for ESG bonds issue by our clients (PLN bn) | 5.9 | 8.0 | >22 |

| Increase in the number of hours worked as part of volunteering | 6 531 | 8 432 | >5 500 |

| Gender pay gap | 37.90% | 35.90% | <35% (-5%) |

Partner in enterprise banking

We support our customers’ growth

We support our customers with transaction banking products that allow their business to run smoothly and safely.